Positive Market Outlook Amid Decreasing Policy Uncertainty

July 24, 2025 - 08:28

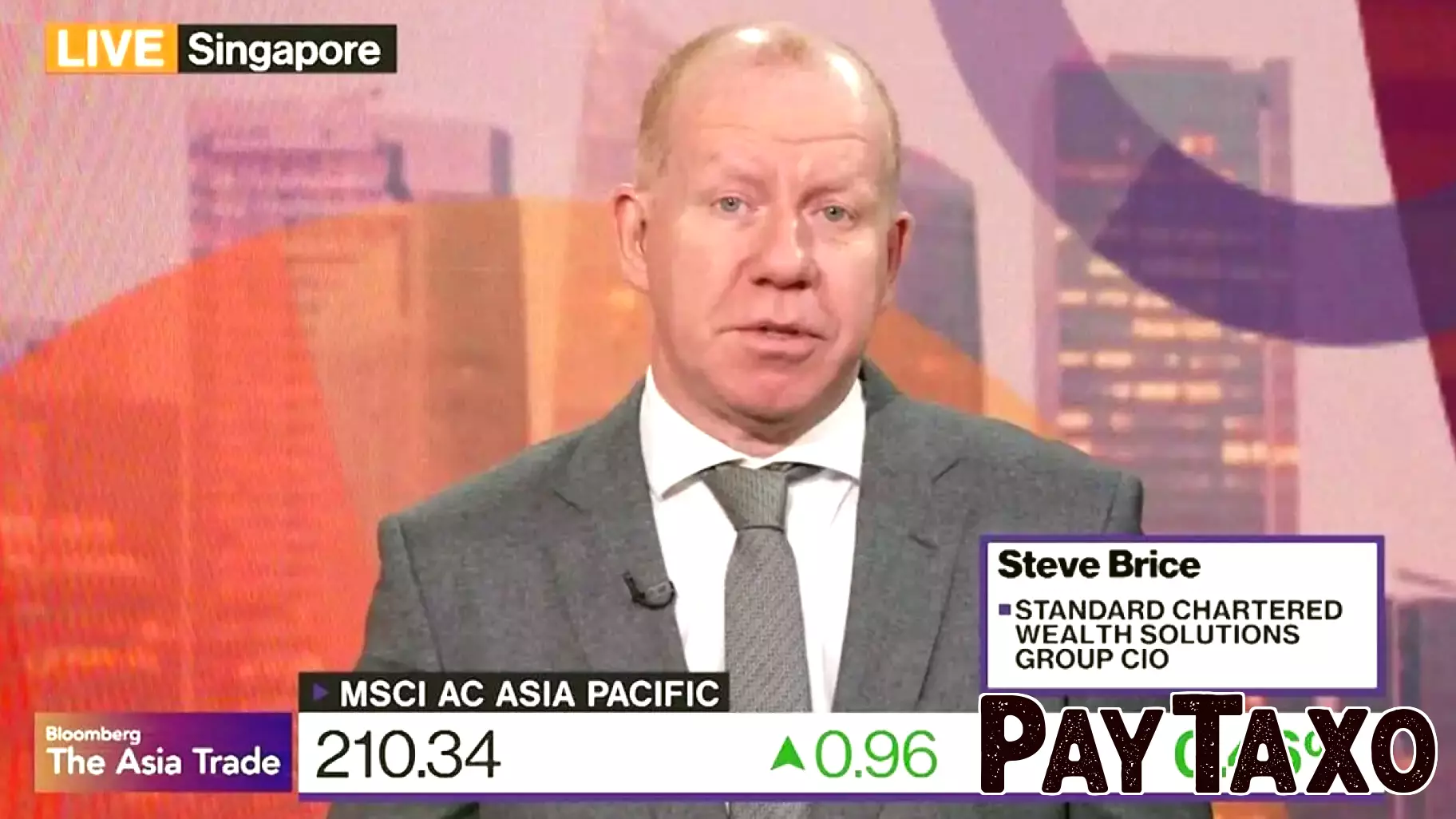

Steve Brice, the Chief Investment Officer of the Wealth Solutions Group, has expressed optimism about the financial markets as he anticipates a significant decline in policy uncertainty in the latter half of the year. According to Brice, this reduction in uncertainty, coupled with a weaker US dollar, is poised to propel markets upward.

In a recent appearance on Bloomberg Television, Brice elaborated on how these factors could create a more favorable environment for investors. He emphasized that as policy clarity improves, market participants are likely to respond positively, leading to increased investment and growth opportunities.

Brice's insights reflect a broader trend of cautious optimism among financial analysts, who believe that stabilizing economic policies can foster confidence in the markets. As investors navigate the complexities of the current economic landscape, Brice's predictions may serve as a guiding light, encouraging a more robust market performance in the months ahead.

MORE NEWS

February 2, 2026 - 10:07

Hana Financial Group Seeks ‘Balanced Growth’ With Non-Bank TurnaroundHana Financial Group has announced a strategic pivot for the coming year, prioritizing a turnaround at its non-banking affiliates to achieve what it terms `balanced growth.` This move signals a...

February 1, 2026 - 19:29

I’m a 66-year-old retired homeowner in Fort Worth, sitting on $143,000 in cash. What should I do with my money?A retired homeowner in Fort Worth, aged 66, is thoughtfully considering the next steps for a substantial $143,000 cash reserve. This scenario highlights a common and crucial crossroads for many...

February 1, 2026 - 05:33

Bitcoin Retreats Below $80,000 as Market Sees Influx of New InvestorsThe price of Bitcoin has fallen below the psychologically significant $80,000 threshold, introducing a note of caution into the recent bullish market sentiment. This dip represents a period of...

January 31, 2026 - 06:28

Is Pathward Financial (CASH) Still Attractively Priced After Strong Recent Share Price GainsInvestors are closely examining Pathward Financial`s stock valuation after a period of significant share price appreciation. The financial services provider has delivered robust returns across...