Record Inflows for US Bitcoin and Ether ETFs Amid Political Shifts

December 2, 2024 - 12:51

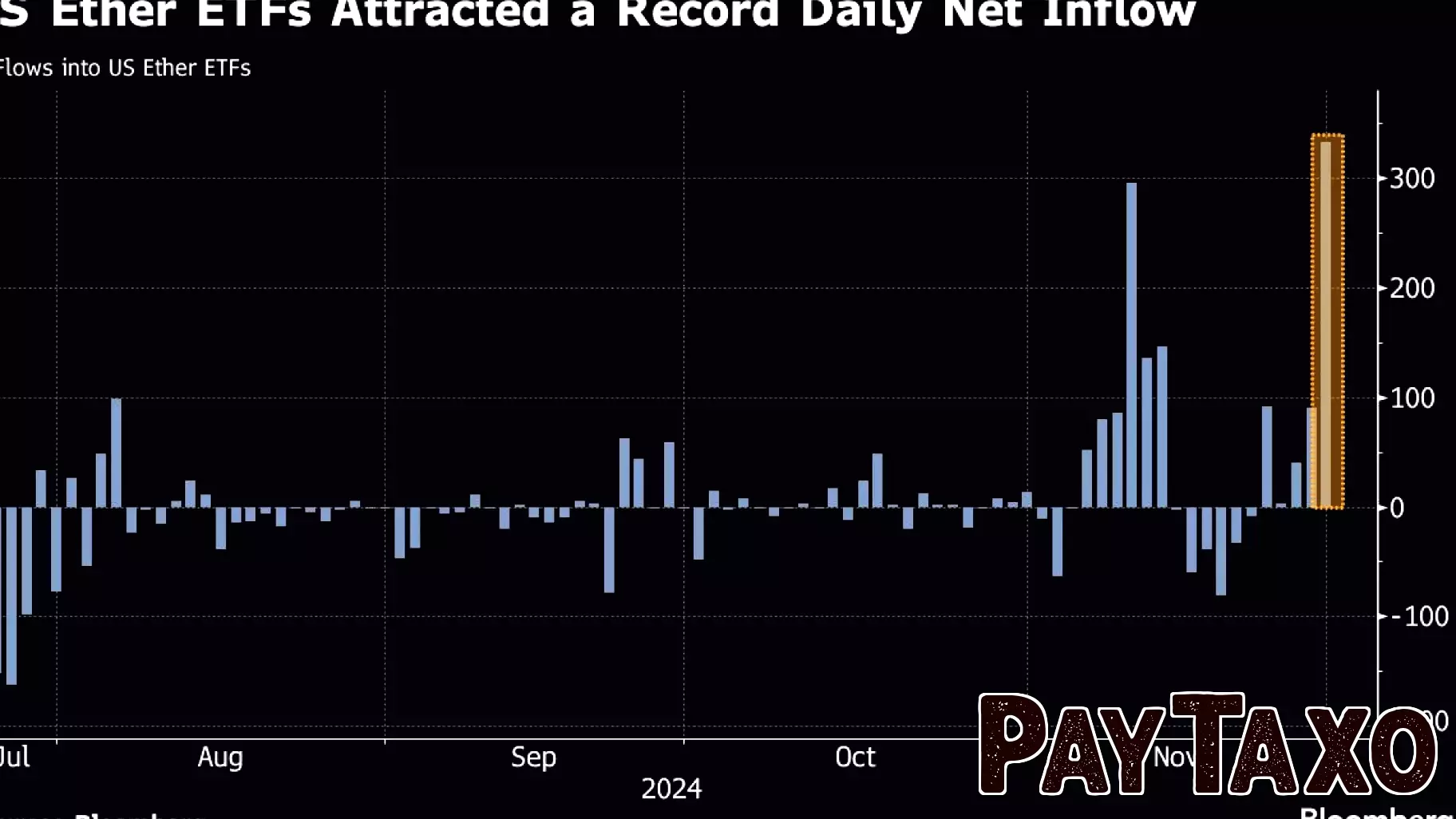

US exchange-traded funds (ETFs) focused on Bitcoin and Ether are experiencing a surge in demand, reaching unprecedented levels. This remarkable growth comes in the wake of President-elect Donald Trump’s commitment to reduce regulatory barriers for the cryptocurrency sector.

In November alone, Bitcoin ETFs saw net inflows totaling $6.5 billion, while Ether ETFs recorded an impressive $1.1 billion in inflows. This influx of capital reflects growing investor confidence in cryptocurrencies, driven by an increasingly favorable political climate.

The significant interest in these digital assets highlights a broader trend as more investors seek exposure to the rapidly evolving cryptocurrency market. With the promise of a more accommodating regulatory environment, many believe that the potential for growth in the crypto space is just beginning.

As the landscape continues to shift, the performance of Bitcoin and Ether ETFs will be closely monitored, as they may serve as barometers for the overall health of the cryptocurrency market in the coming months.

MORE NEWS

February 2, 2026 - 10:07

Hana Financial Group Seeks ‘Balanced Growth’ With Non-Bank TurnaroundHana Financial Group has announced a strategic pivot for the coming year, prioritizing a turnaround at its non-banking affiliates to achieve what it terms `balanced growth.` This move signals a...

February 1, 2026 - 19:29

I’m a 66-year-old retired homeowner in Fort Worth, sitting on $143,000 in cash. What should I do with my money?A retired homeowner in Fort Worth, aged 66, is thoughtfully considering the next steps for a substantial $143,000 cash reserve. This scenario highlights a common and crucial crossroads for many...

February 1, 2026 - 05:33

Bitcoin Retreats Below $80,000 as Market Sees Influx of New InvestorsThe price of Bitcoin has fallen below the psychologically significant $80,000 threshold, introducing a note of caution into the recent bullish market sentiment. This dip represents a period of...

January 31, 2026 - 06:28

Is Pathward Financial (CASH) Still Attractively Priced After Strong Recent Share Price GainsInvestors are closely examining Pathward Financial`s stock valuation after a period of significant share price appreciation. The financial services provider has delivered robust returns across...