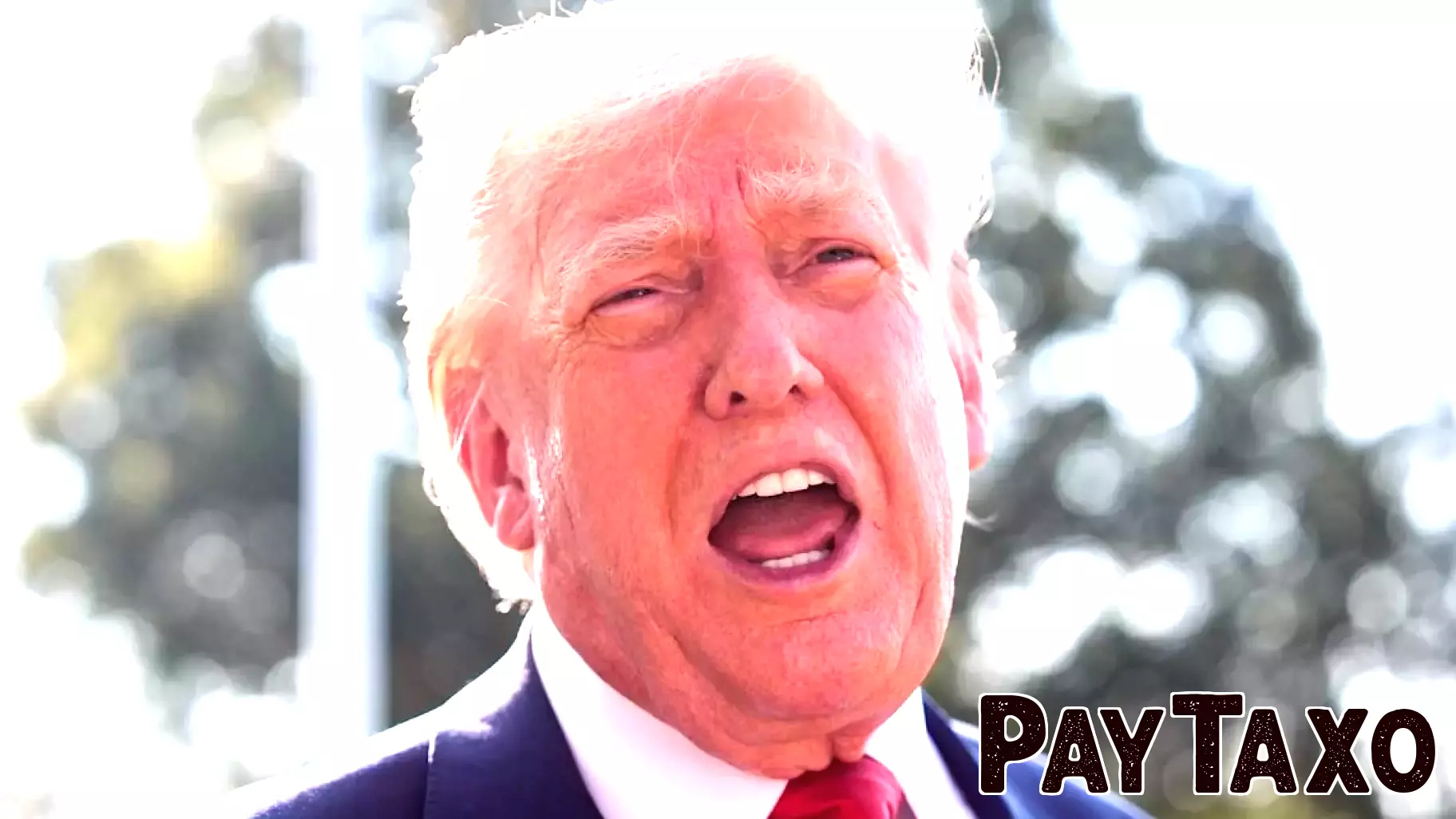

Trade Deals and Rising Consumption Taxes: A Surprising Stock Market Surge

July 27, 2025 - 03:32

In an unexpected turn of events, recent trade agreements are leading to an increase in consumption taxes, yet stock markets continue to show resilience and growth. Analysts are puzzled by this phenomenon, as higher taxes typically dampen consumer spending and raise concerns about economic slowdown. However, investors seem to be viewing the situation through a different lens.

The rationale behind this optimism can be attributed to several factors. First, the trade deals are expected to boost economic activity in the long run, as they open new markets and create opportunities for businesses. Additionally, companies are adapting to the changing landscape by adjusting their pricing strategies and enhancing operational efficiencies, which can offset the impact of increased taxes.

Furthermore, the current economic climate, characterized by low unemployment rates and strong corporate earnings, provides a solid foundation for continued stock market growth. As investors weigh the potential benefits of these trade agreements against the backdrop of higher consumption taxes, the overall sentiment remains bullish. This juxtaposition of rising taxes and a thriving stock market raises intriguing questions about the future of economic policy and its effects on consumer behavior.

MORE NEWS

February 2, 2026 - 10:07

Hana Financial Group Seeks ‘Balanced Growth’ With Non-Bank TurnaroundHana Financial Group has announced a strategic pivot for the coming year, prioritizing a turnaround at its non-banking affiliates to achieve what it terms `balanced growth.` This move signals a...

February 1, 2026 - 19:29

I’m a 66-year-old retired homeowner in Fort Worth, sitting on $143,000 in cash. What should I do with my money?A retired homeowner in Fort Worth, aged 66, is thoughtfully considering the next steps for a substantial $143,000 cash reserve. This scenario highlights a common and crucial crossroads for many...

February 1, 2026 - 05:33

Bitcoin Retreats Below $80,000 as Market Sees Influx of New InvestorsThe price of Bitcoin has fallen below the psychologically significant $80,000 threshold, introducing a note of caution into the recent bullish market sentiment. This dip represents a period of...

January 31, 2026 - 06:28

Is Pathward Financial (CASH) Still Attractively Priced After Strong Recent Share Price GainsInvestors are closely examining Pathward Financial`s stock valuation after a period of significant share price appreciation. The financial services provider has delivered robust returns across...