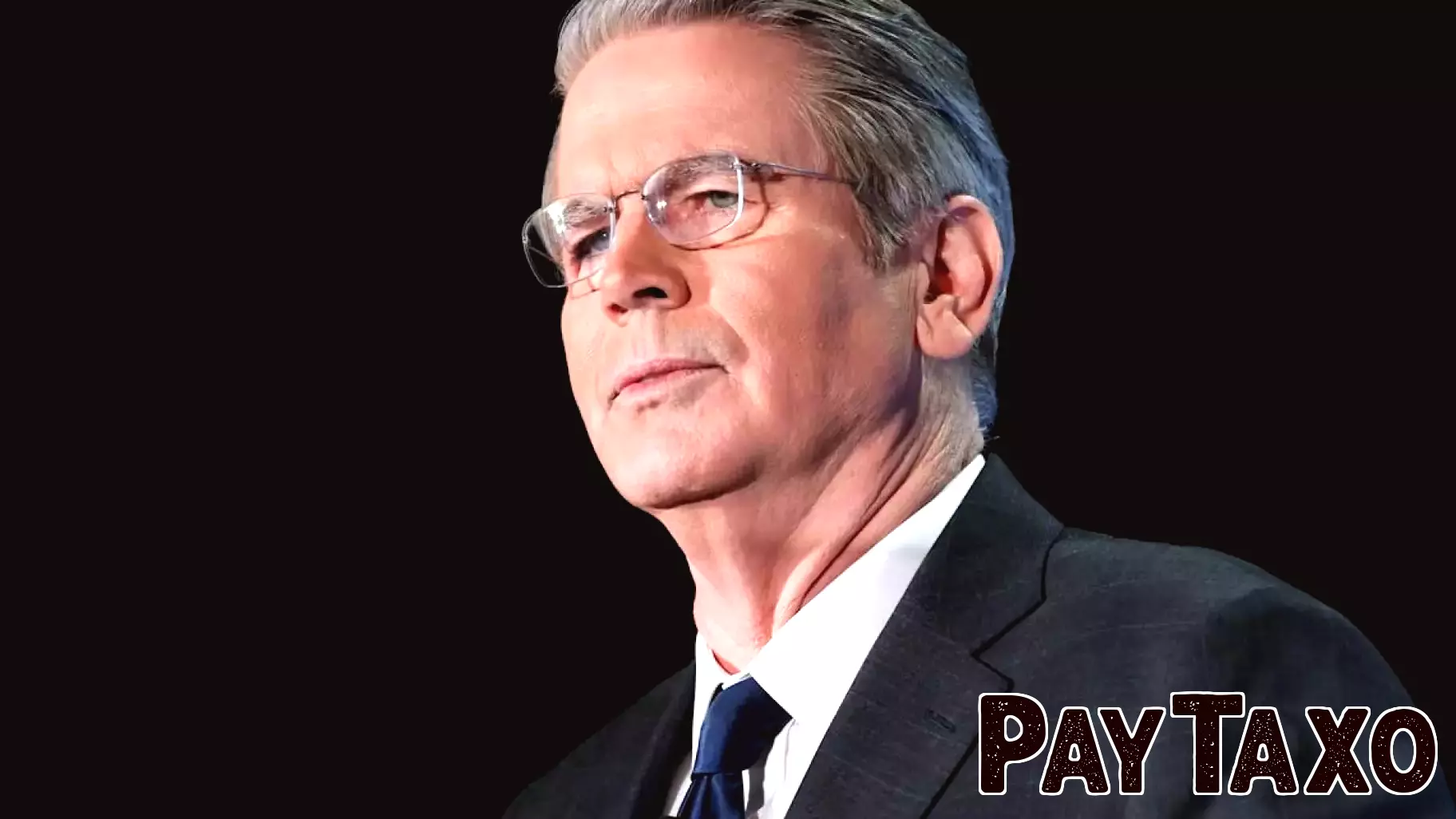

US Treasury Secretary Anticipates Easing Tensions with China

April 23, 2025 - 03:05

US Treasury Secretary Scott Bessent expressed optimism on Tuesday regarding the ongoing trade tensions between the United States and China. In remarks shared with individuals familiar with his statements, Bessent emphasized that the current trade war is unsustainable and highlighted the importance of finding common ground. He indicated that the primary objective is not to completely sever economic ties, but rather to foster a more stable and cooperative relationship between the two nations.

Bessent's comments come amid ongoing discussions about tariffs and trade policies that have strained relations over the past few years. The Secretary's perspective reflects a growing sentiment among policymakers that a de-escalation of tensions is necessary for both countries to thrive economically. As the global economy continues to grapple with various challenges, the focus appears to be shifting towards collaboration rather than confrontation, signaling a potential turning point in US-China relations.

MORE NEWS

February 2, 2026 - 10:07

Hana Financial Group Seeks ‘Balanced Growth’ With Non-Bank TurnaroundHana Financial Group has announced a strategic pivot for the coming year, prioritizing a turnaround at its non-banking affiliates to achieve what it terms `balanced growth.` This move signals a...

February 1, 2026 - 19:29

I’m a 66-year-old retired homeowner in Fort Worth, sitting on $143,000 in cash. What should I do with my money?A retired homeowner in Fort Worth, aged 66, is thoughtfully considering the next steps for a substantial $143,000 cash reserve. This scenario highlights a common and crucial crossroads for many...

February 1, 2026 - 05:33

Bitcoin Retreats Below $80,000 as Market Sees Influx of New InvestorsThe price of Bitcoin has fallen below the psychologically significant $80,000 threshold, introducing a note of caution into the recent bullish market sentiment. This dip represents a period of...

January 31, 2026 - 06:28

Is Pathward Financial (CASH) Still Attractively Priced After Strong Recent Share Price GainsInvestors are closely examining Pathward Financial`s stock valuation after a period of significant share price appreciation. The financial services provider has delivered robust returns across...